"Together we are even stronger" – this is the heading for msg GillardonBSM AG’s partner section on their website. knowis AG also regularly works together with business partners to offer customers from the financial sector digital solutions that are tailored to their needs. In a joint project, the two companies have now implemented a software application that prototypically demonstrates the potential of automating decisions in the lending process – an excellent starting point for deepening the partnership.

The onset of the COVID-19 pandemic and the resulting spike in applications for development loans and other financial aid exposed the gaps in the digitization of lending processes very clearly: the processing of applications was delayed at many credit institutions and there were capacity bottlenecks. A team of experts from msg GillardonBSM took these developments as an opportunity to analyze the weak points in current lending processes. On this basis, the 'CreditDecisionWorkflow' (CDW for short) application was developed as a prototype software solution that demonstrates the potential of automation in the credit sector.

msg GillardonBSM is a company with a long tradition and more than 100 years of experience in the industry that advises banks on how to optimize their business success, among other things. In the past, msg GillardonBSM has already worked with knowis on several occasions to support customers from the lending sector on their digital transformation journey. The two companies know each other and value their collaboration – so it is only natural that when implementing a credit application, msg GillardonBSM counts on the knowis expertise in the development of digital solutions in the lending business.

Consulting Company Meets Solution Provider: It’s a Match!

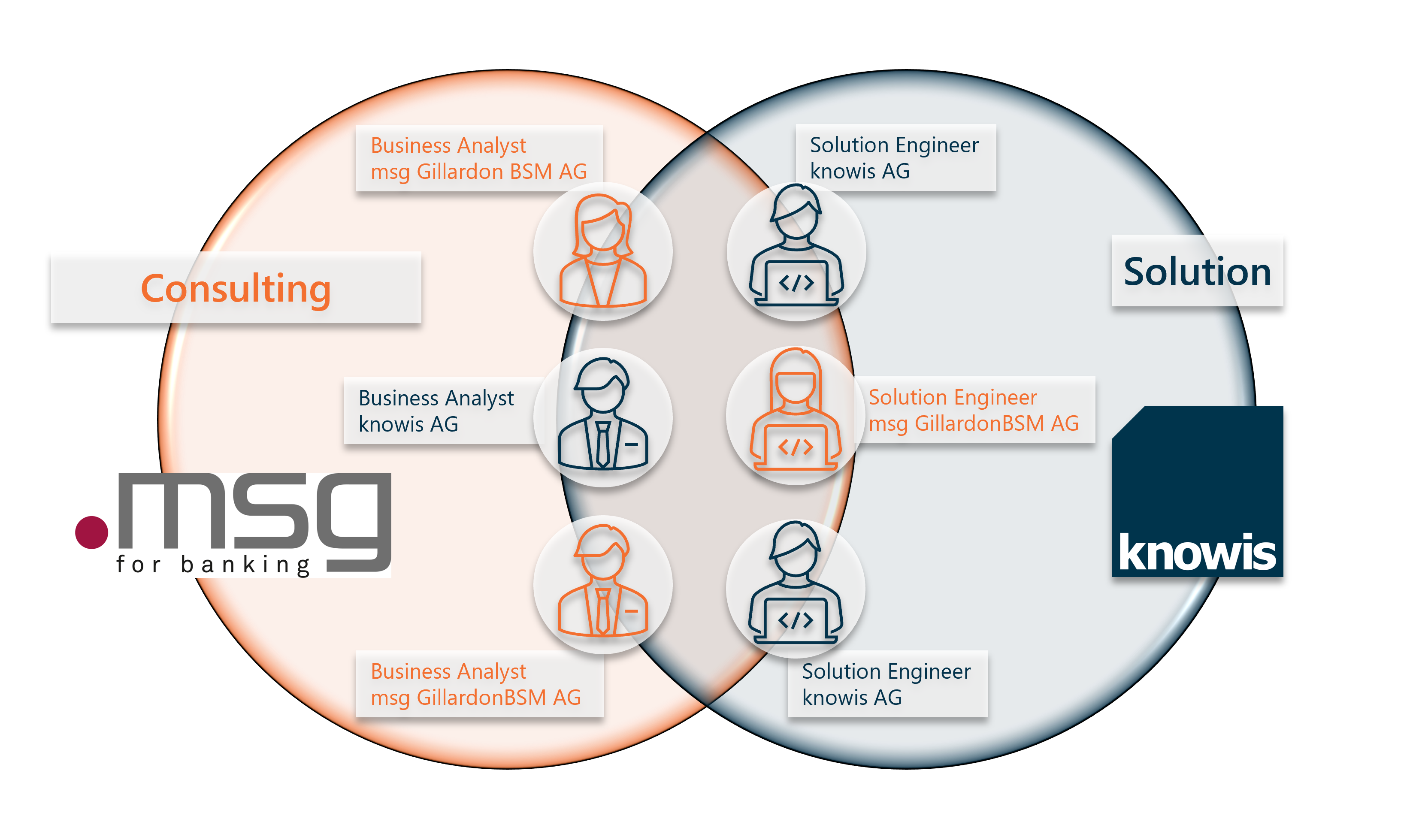

One of the reasons for the successful partnership between msg GillardonBSM and knowis is certainly the synergy at the interface between consulting and solution. The mutual customers benefit greatly from the fact that msg GillardonBSM's spectrum not only includes business consulting in the financial sector, but also encompasses comprehensive technological competence resulting from the company's software division. Likewise, knowis AG is not exclusively a provider of a banking platform for the realization of lightweight business applications, but also offers a full range of services covering all aspects of digitization projects – from the initial idea to the finished solution.

The approach taken in the joint 'CreditDecisionWorkflow' project is also based on this overlap. With the primary goal of leveraging efficiency potential through the complete digitization of credit approval processes, a cross-company project team was formed. Another objective was to benefit from the bilateral exchange of knowledge and deepen the cooperation between the two partners. In order to ensure the seamless interplay of conceptual design and implementation, both companies provided team members with business expertise and team members with technical specialization. The business focus was on msg GillardonBSM, the technical focus on knowis.

Using Agile Methods to Achieve the Goal of Automating Credit Decisions

msg GillardonBSM's approach was clear: increase the competitiveness of banks through a standardized and fully digital credit decision process. A key point here was to achieve the greatest possible automation and minimize manual activities – an important step on the way to zero back office. This results in lower error rates, an increase in speed and efficiency, a reduction in redundancy, and ultimately an optimization of time-to-yes and time-to-cash.

With clearly defined roles and carefully planned timeframes and milestones, the software solution was realized collaboratively in agile sprints. The project began with a user story mapping workshop. "We have experienced in our customer projects that taking on the perspectives of user personas and getting an overview of the entire process flow is very helpful. This was once again confirmed during the development of the 'CreditDecisionWorkflow' application together with msg GillardonBSM, and thanks to the story map, we had a shared understanding right from the start," says Christian Müller, Business Analyst at knowis AG.

With clearly defined roles and carefully planned timeframes and milestones, the software solution was realized collaboratively in agile sprints. The project began with a user story mapping workshop. "We have experienced in our customer projects that taking on the perspectives of user personas and getting an overview of the entire process flow is very helpful. This was once again confirmed during the development of the 'CreditDecisionWorkflow' application together with msg GillardonBSM, and thanks to the story map, we had a shared understanding right from the start," says Christian Müller, Business Analyst at knowis AG.

During the two-week sprints, the application was then developed using the knowis solution platform isfinancial. With the platform's no-code design tools, business analysts can easily create the domain-specific foundation for business applications themselves, which significantly reduces the time and personnel required for application development. A team of three solution engineers was responsible for implementing the CDW credit application in the project. Here, too, isfinancial provides support in the form of an extensive low-code UI framework, enabling program interfaces to be created quickly with little effort or prior knowledge. For dynamic views and processes, isfinancial utilizes IBM Business Automation Workflow.

With the shared tool isfinancial and consistent project planning and management, the team of experts from msg GillardonBSM and knowis succeeded in implementing a complex software solution with 'CreditDecisionWorkflow' in a targeted and efficient manner. The project illustrates that with progressive solution approaches, a well thought-out procedure and, last but not least, the right partners, it is possible to achieve automation and thus significant improvements in terms of speed, efficiency and revenue even in very complex application areas such as the credit sector. Alexander Rautzenberg, who managed the CDW project on the msg GillardonBSM side, is also convinced of the partnership: "Our successful cooperation with knowis allows us to shape an innovative credit business of the future by combining our strengths."

With the shared tool isfinancial and consistent project planning and management, the team of experts from msg GillardonBSM and knowis succeeded in implementing a complex software solution with 'CreditDecisionWorkflow' in a targeted and efficient manner. The project illustrates that with progressive solution approaches, a well thought-out procedure and, last but not least, the right partners, it is possible to achieve automation and thus significant improvements in terms of speed, efficiency and revenue even in very complex application areas such as the credit sector. Alexander Rautzenberg, who managed the CDW project on the msg GillardonBSM side, is also convinced of the partnership: "Our successful cooperation with knowis allows us to shape an innovative credit business of the future by combining our strengths."

NEWS FROM THE COLLABORATION

Update [08/26/21]: Since msg GillardonBSM is not just a consultancy firm, but also a leading provider of calculation kernels and standard software solutions for banks, the logical next step is to deepen the partnership on a technological level as well. With the further development of the CDW prototype, the technological alliance between msg GillardonBSM and knowis has now also been realized.

To optimize complex credit processes, an effective interest rate calculator provided by the MARZIPAN calculation kernel was connected to the CDW application. The integration is realized via the isfinancial banking platform, on which a new service addresses the interfaces of MARZIPAN and delivers the data back to the application. Thus, after entering the loan application data, the market employee receives precisely calculated data such as the effective interest rate and the repayment schedule without having to change the application.

msg GillardonBSM has published an extensive (German-language) article in its customer magazine NEWS on the functional aspects and details of the development of the CDW application for the end-to-end digitization of lending processes.

Conclusion

In the age of the digital transformation of banking, it is essential to create added value through cooperation with third parties. This is not only true for banks and financial services providers themselves, which are increasingly positioning themselves in ecosystems in order to be able to offer their customers tailored products and services and to retain their loyalty. As a solution provider for the financial industry, we at knowis are also always on the lookout for strong partners in order to be able to provide the best possible solution for our customers' requirements.

Are you interested in a business partnership with knowis or do you want to learn more about our approach to digital transformation projects or our banking platform isfinancial? Then do not hesitate and contact us. We look forward to an exchange!

Image Sources: Teaser: scyther5 – 1179188076 – istock; Infographic: knowis AG; Portraits: knowis AG, msg GillardonBSM AG.