The COVID-19 pandemic has unleashed a torrent of new funding and subsidy applications, causing increased administrative overhead in the lending business. In the current issue of our series Business Solutions in Banking, we show you how pricing can be implemented into the loan application and approval process without the need for switching between systems. A banking platform allows you to digitalize loan processes and integrate existing pricing solutions seamlessly.

As anticipated, the coronavirus pandemic has had an impact on the earnings performance of German banks in the lending business. According to the Deutsche Bundesbank's latest report on the performance of German credit institutions in 2020, a surge in risk provisioning has pushed up margin requirements in the lending industry. Correct pricing, then, is imperative for a profitable lending system that is commensurate with the level of risk involved. Yet, for many banks, pricing still requires a painstaking manual process involving a plethora of applications. A platform that is integrated directly into the digital credit application processing system can simplify and accelerate this procedure significantly.

Pricing in the lending business: too convoluted for too many years

Most financial institutions are already using pricing engines: software solutions that process calculations for banks. They are either developed in house or purchased as a standard software suite. In many cases, however, this software is not seamlessly integrated into the application process. This forces employees to switch between applications and creates duplicate work as data has to be transferred to multiple programs manually.

Changes in pricing-relevant credit application data, for example, require recalculations in the preliminary costing. Renegotiating or prolonging the term of a loan agreement increases the workload even further. The bank employees responsible for loan conditions usually do not receive a simple comparison of the preliminary and final costing, which poses additional challenges. Fundamental factors, such as the actual utilization of credit limits or the relevant rating at the time of calculation, are not visualized clearly enough for employees to spot inconsistencies efficiently.

In short: the basis on which conditions are set depends on parameters that are difficult to document, and software can only support this process to a limited extent. As a result, institutes struggle to prove to the supervisory authorities that the pricing of a loan was commensurate with its risk profile at a specific point in time.

A banking platform for fast and secure pricing processes

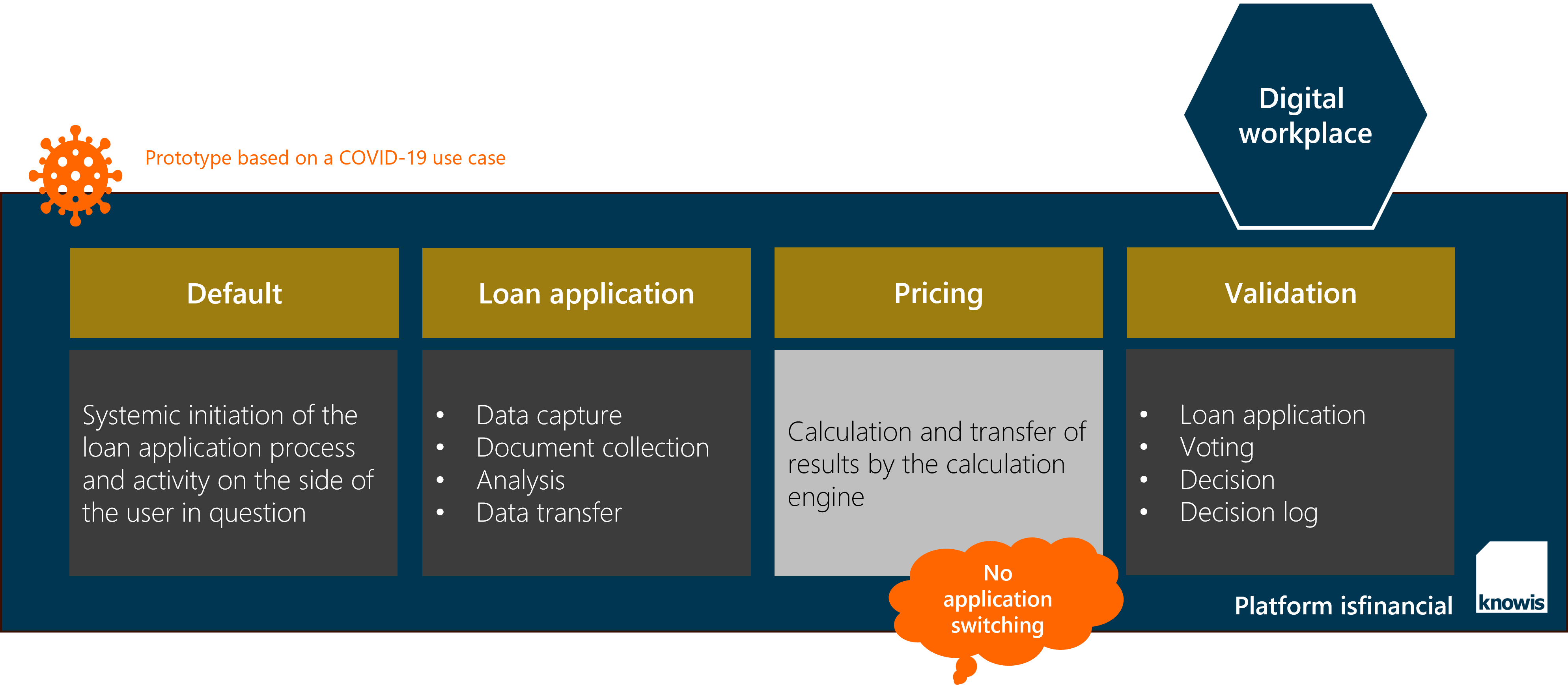

The isfinancial banking platform lets you implement institute-specific business applications quickly and securely. Its modular structure allows users to use/implement existing pre-designed components. Using this system, we were able to implement a software solution for processing loan applications and integrate an existing calculation engine as a module. All of this was done in a prototype application.

The software application extracts all data that are relevant to the calculation from the credit application, sends it to a market-leading calculation tool, and imports the result of the calculation back into the credit application. This process takes place automatically within a single app and without any manual effort. When relevant parameters are changed, the software automatically and seamlessly revises the calculation.

Integrating the platform directly into the digital loan application processing system has the potential to increase transparency in the decision-making process considerably. The prototype further covers defaults, which have been on the rise as a result of payment deferrals and the restructuring of loan cash flows caused by knock-on effects from the coronavirus pandemic over the past few months. Not only does the prototype app relieve experts of the manual work usually involved in the loan conditioning process, it also logs all the data on a central platform, making the basis on which the conditions were set and the decisions made in the process perfectly transparent at all times.

The working prototype was implemented in a few sprints with a very short time-to-solution: the platform is based on a no-code design and low-code implementation approach, allowing specialist users and implementation teams in IT-related fields to create digital business applications rapidly and collaboratively. Experts and trained teams in IT-related fields can use pre-designed tools and technologies to quickly implement a respective, customized application rapidly on the platform.

Conclusion

The overwhelming increase in new applications and adjustments of loan agreements caused by COVID-19 poses a major challenge to financial institutions. Appropriate pricing and loan conditions can counteract the additional risks involved. With isfinancial, banks can rapidly implement customized software solutions that help them tackle this challenge.

The prototype for defaults and loan conditions allows the pricing process to be integrated seamlessly into the application process and largely automated. The platform can manage calculation rules and integrate an existing pricing engine as a module. Not only does this lower transaction fees by relieving experts of the burden of manual data entry and copying, it also increases the transparency of the relevant parameters involved in condition decisions, as revised conditions, preliminary costings, and final costings can be made available at any time.

Want to learn more about our banking solutions? Use our contact form to get in touch with our experts.

Teaser: HAKINMHAN - 664599098 - iStock; infographic: knowis AG.