At least since the second EU Payment Services Directive PSD2 came into force, API banking has become a much discussed topic. The test phase for the interfaces that banks will have to provide under the policy runs until September 2019, and third-party vendors are already experimenting with them. In the same breath as API banking, the term open banking is often referred to, or the two are used synonymously; experts talk about new ecosystems in the center of which credit institutions are to position themselves. Be open or die is the common refrain in the financial world. But what role do APIs play in banking at all, and how is their use related to opening the financial industry?

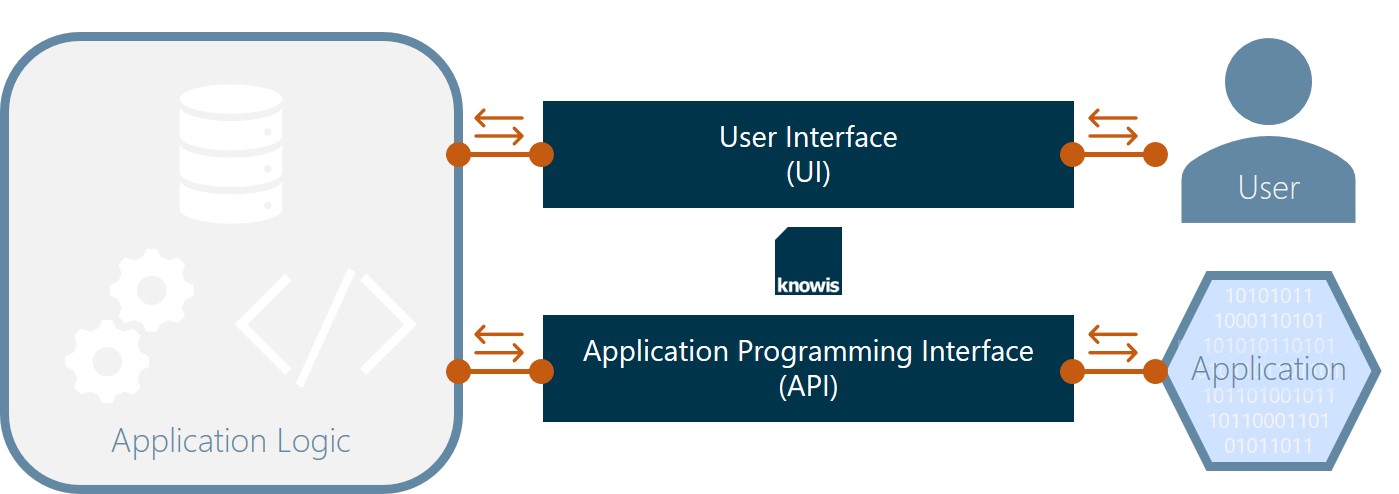

APIs are the connectors of the digital world: they break up monolithic systems and create connections by enabling the exchange of data and logic between stand-alone software applications. Just as a user interface (UI) serves to make software logic consumable for and allows interaction with a human user, an application programming interface (API) allows interaction with other software applications. To enable programmers to implement and test this connection between two applications, APIs are provided along with detailed documentation that explains, for example, operations and their parameters to human beings. To create documentation that is as structured as possible, established standards such as Swagger 2.0 or OpenAPI 3.0 can be used.

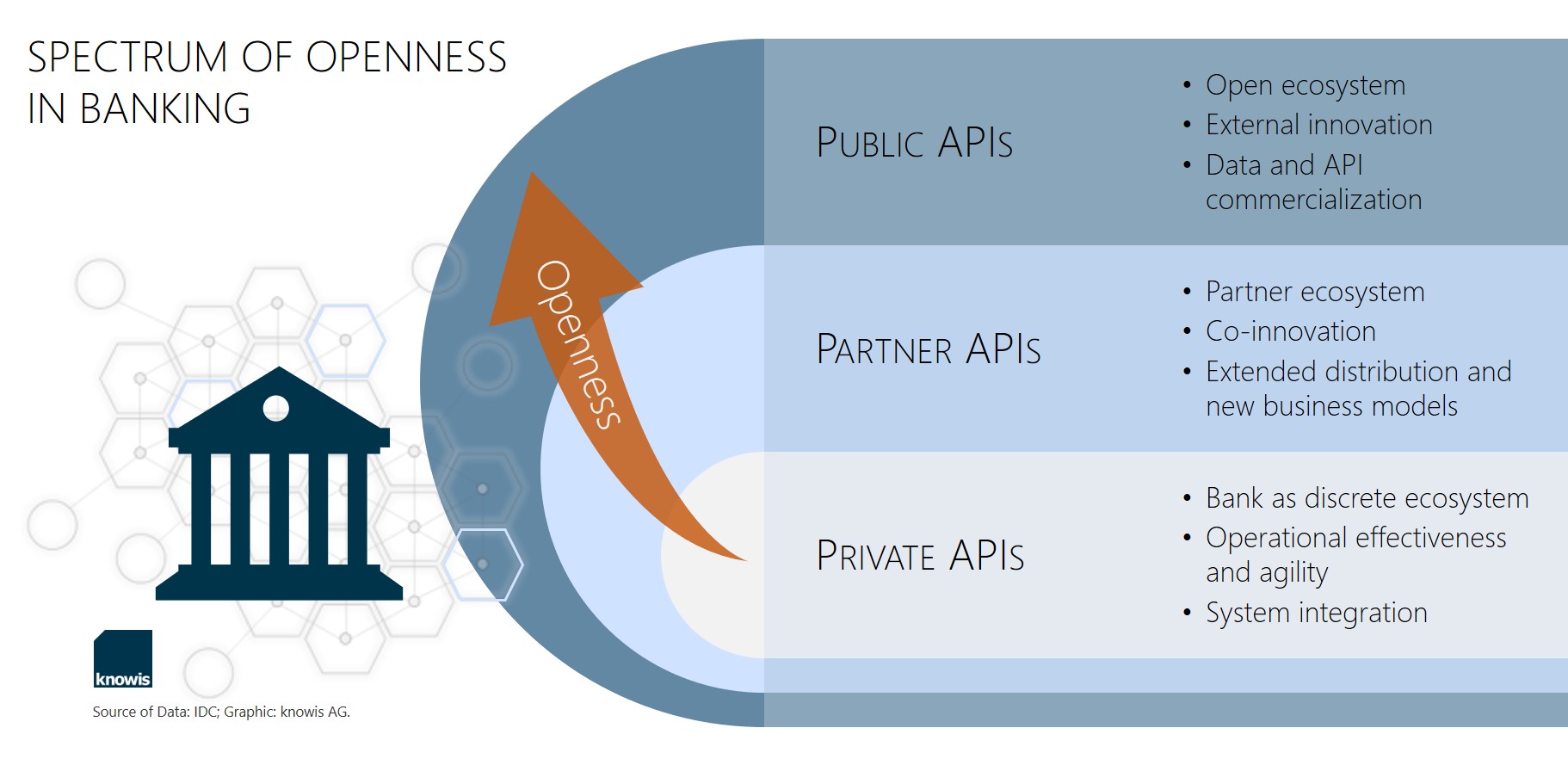

Depending on who gets access to the interfaces, APIs can roughly be classified into three types:

- Public APIs can be used by third parties to use data and logic from existing software in their own applications. In general, the access rights via these APIs are limited, and the interfaces are highly secure.

- Partner APIs allow a selected network of business partners to access the functionality of other software applications.

- Private APIs are only accessible within a company and are primarily used to network individual applications.

A similar classification is also made by McKinsey in connection with data exchange in banking. A modern business architecture of financial institutions typically uses all three types of APIs to be agile and position themselves for the future.

Flexible Business Architecture Through Private APIs

Private APIs do not help open a bank to the outside world, which is why they do not receive too much attention in the era of PSD2. Nevertheless, they are essential for an advanced software landscape in finance: Private APIs are the essential foundation for designing a flexible and modern business architecture. On the one hand, they enable a simple and cost-effective integration of new applications and systems into existing systems that have grown over the years. On the other hand, individual, small-scale applications can interact with each other via private APIs, thus exchanging data and software logic.

Only then is it possible to do justice to the complex subject of finance and to break it down and contextually model it, following the concept of domain-driven design. On this basis, modular, independent solution components can be developed as microservices, which can be flexibly combined and interact via the private interfaces. This provides several advantages: the functional logic of the individual business domains is reflected in the software architecture; the small-scale modules are easier to extend and maintain; and a gradual implementation of digital transformation projects reduces the hurdle for the first step towards a future-proof, agile banking platform that seamlessly ties in with existing systems.

APIs, PSD2 and Open Banking

In the context of a banking platform, the call for well-networked financial ecosystems is also becoming louder and louder. Open banking is often portrayed as a panacea against the death of banks and as a logical consequence of PSD2; after all, the EU regulation requires banks to provide third parties with public interfaces via which they have access to customers‘ banking details after the customers have given their consent. This is where public APIs and partner APIs come into play: Their deployment always involves an outward opening and positioning within an ecosystem in the broadest sense.

But when is a bank open? Deploying the appropriate interface types beyond PSD2, it can rank in a more or less open banking ecosystem within a "spectrum of openness," as defined in the IBM-commissioned 'Open Banking Transformation Strategies' by market research and consulting firm International Data Corporation (IDC). The use of public APIs aims even more at cooperation with innovative partners and commercial provision of data and APIs. Both public and partner APIs help financial institutions expand their reach and attract new customers on third-party platforms – such as online merchants offering financing through bank interfaces. Conversely, the APIs allow customers to use financial services on third-party platforms outside the financial sector as well. For them, this provides a smooth customer journey, for example, when they can complete the financing, perhaps even through their house bank, directly on the site of the online retailer when buying a new smartphone.

Leverage the Strengths of Others – Banks as Consumers of APIs

Of course, banks should not focus solely on providing APIs, but should also use the interfaces of external third parties to prepare for the future. Data mining services such as North Data can be integrated via APIs in order to obtain information about Commercial Register entries quickly and easily. Selective outsourcing of services can be an equally interesting aspect for financial service providers: Due to economies of scale, specialized providers can often offer them much cheaper. By consuming the service provider API, the finance company can reduce the cost of routine processes and focus on its core competencies.

And even smart technologies can be easily integrated via APIs. Banks can connect to AI-based chatbot solutions, for example, or utilize risk management skills of machine learning, such as IBM Watson Machine Learning, in credit scoring. Artificial intelligence is no longer science fiction, but state of the art and, thanks to extensive historical data sets, a usable and valuable instrument for financial institutions.

In addition to the use of state-of-the-art technologies, it is equally important for companies today to come up with a range of products that meet the expectations of their customers in a digitized environment. The rather conservative banks are no longer an exception and must face the fact that rethinking is necessary in order to avoid being displaced by digital natives in the evolution of the financial industry. In addition to uninterrupted customer service from the bank counter to the banking app, this also includes the provision of a customized range of services.

But financial institutions are already well prepared for this challenge. Many users want relevant, personalized offers. Since account transaction data, in contrast to likes on social media, reflects actual behavior, it is an ideal foundation to meet this expectation. Through integrated third-party APIs in their online banking environment, customers have the option of receiving additional service offerings upon request. And they get this without having to divulge their data in various places, where it is much less protected. The range of services can certainly go beyond traditional banking business. For example, it can help to improve the customer experience if the bank’s trusted app offers an option to directly select the appropriate mobile service plan or to get insurance for the newly purchased smartphone.

But financial institutions are already well prepared for this challenge. Many users want relevant, personalized offers. Since account transaction data, in contrast to likes on social media, reflects actual behavior, it is an ideal foundation to meet this expectation. Through integrated third-party APIs in their online banking environment, customers have the option of receiving additional service offerings upon request. And they get this without having to divulge their data in various places, where it is much less protected. The range of services can certainly go beyond traditional banking business. For example, it can help to improve the customer experience if the bank’s trusted app offers an option to directly select the appropriate mobile service plan or to get insurance for the newly purchased smartphone.

Interlinking Value Chains to Ecosystems

The connections that APIs create are not one-way streets. A real ecosystem is created by a mutual give and take. Banks and their partners should therefore exploit the opportunities offered by such networks and link their value chains even more closely. A bank could, for instance, offer its small and medium-sized corporate customers targeted products for their operating equipment. Based on the information already available to the bank, offers can be created that are in fact relevant. In case of choosing such a partner offer, the customer can also access the actual core service of his or her bank and finance the purchase. Corporate customers benefit from favorable offers due to partnerships, and from customized financing. Banks and partners strengthen each other and open up new sales channels. Thus, the symbiosis is perfect and advantages for all actors arise.

Conclusion

APIs are essential in today's and tomorrow's banking in many ways. In the context of digital transformation, they can be utilized primarily to build a modular, flexible and robust business architecture, which is often not the first association when the term API banking is mentioned. With regard to an opening of the banking industry, the interfaces of course also enable bidirectional cooperation with third parties. However, each bank needs to position itself within the spectrum and strive for the appropriate level of openness, depending on the customer base and strategic orientation.

Ecosystems, which are widely publicized in this context, will not emerge overnight in the banking world. However, if financial institutions develop their power of innovation and build up successively growing partner networks based on concrete, small-scale use cases to provide their customers with real added value, they have the greatest opportunity to consolidate their position of trust and survive in an increasingly competitive industry. The ecosystem is not in the foreground but is – behind the scenes and invisible to the customer – shaped by APIs and filled with life via these interfaces. If this succeeds, all parties involved ultimately emerge as winners: the customer conveniently receives tailored offers on the portal he or she is currently visiting, and banks and their partners strengthen each other.

Image Sources: Teaser: utah778 - 827843530 - iStock; Infographics: knowis AG